The Savings and Loans Crisis: A Landmark in Financial History

The Savings and Loans Crisis: A Landmark in Financial History

In 1991, a landmark moment in financial history unfolded as three individuals, Faulkner, Blain, and Toler, were convicted of civil racketeering and looting millions from S&Ls through fraudulent land deals. This event marked the culmination of a broader crisis that had been unfolding since the mid-1980s.

Context

The Savings and Loans (S&L) industry played a crucial role in the US economy during the post-war period. Deregulation, which began in the 1970s, led to a surge in S&L activity as institutions were allowed to engage in riskier investments. However, this also created an environment conducive to fraud and abuse.

Timeline

• 1986: The first signs of trouble emerge as several S&Ls begin to show significant losses due to poor management and fraudulent activities. • 1987: Congress passes the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA), which aimed to strengthen regulation and oversight of the S&L industry. • 1990: The number of failed S&Ls increases dramatically, with over 200 institutions collapsing or being merged out of existence. • May 1991: 764 people are charged with various offenses related to the crisis, with 550 convictions and 326 jail sentences. • 1995: The final cost of the Savings and Loans crisis is estimated at $153 billion (around 3% of GDP), with taxpayers footing the bill for $124 billion.

Key Terms and Concepts

- Deregulation: The process of removing or reducing government regulations, often resulting in increased freedom but also increased risk.

- Savings and Loans (S&L) crisis: A period of significant financial turmoil affecting S&L institutions, characterized by widespread fraud, abuse, and ultimately, collapse.

- Civil racketeering: A form of organized crime involving the use of deception, corruption, or intimidation to gain control over a business or institution.

- Resolution Trust Corporation (RTC): A government agency established in 1989 to oversee the cleanup of failed S&Ls and manage their assets.

Key Figures and Groups

- Edwin Gray: The Chairman of the Federal Home Loan Bank Board during the crisis, who described it as “the most widespread, reckless, and fraudulent era in this nation’s banking history.”

- Faulkner, Blain, and Toler: Convicted individuals responsible for looting millions from S&Ls through fraudulent land deals.

- Congress: The legislative body that passed the FIRREA, attempting to strengthen regulation and oversight of the S&L industry.

Mechanisms and Processes

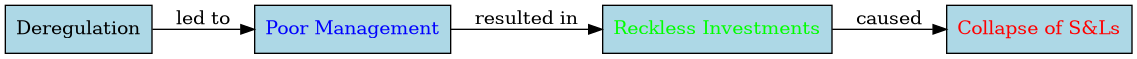

The crisis unfolded as follows:

- Deregulation led to a surge in S&L activity, creating an environment conducive to fraud and abuse.

- Poor management and fraudulent activities became widespread, with many institutions engaging in reckless investments.

- The number of failed S&Ls increased dramatically, with over 200 institutions collapsing or being merged out of existence.

- Congress passed the FIRREA, attempting to strengthen regulation and oversight.

- Investigators uncovered widespread fraud and abuse, leading to convictions and sentences.

Deep Background

The Savings and Loans crisis was a symptom of deeper issues within the US financial system. The post-war economic boom, which saw rapid growth and expansion, created an environment where institutions were encouraged to take risks and engage in speculative investments. However, this also led to a lack of oversight and regulation, creating an opportunity for fraud and abuse.

Explanation and Importance

The Savings and Loans crisis was a landmark moment in financial history due to its sheer scale and impact. The crisis resulted in significant losses, with taxpayers footing the bill for $124 billion. It also highlighted the importance of effective regulation and oversight in preventing such crises from occurring in the future.

Comparative Insight

A similar crisis occurred in the 1980s British banking scandal, where several banks were involved in a series of unscrupulous activities, including insider trading and money laundering. While the two crises share similarities, they also have distinct differences, highlighting the importance of understanding specific historical contexts.

Extended Analysis

- Sub-theme 1: Regulatory Failure

- The Savings and Loans crisis was a result of regulatory failure, with institutions engaging in reckless investments due to inadequate oversight.

- Sub-theme 2: Systemic Risk

- The crisis highlighted the importance of addressing systemic risk, as widespread fraud and abuse created an environment conducive to collapse.

- Sub-theme 3: Long-term Consequences

- The Savings and Loans crisis had long-term consequences, with many institutions failing and taxpayers footing the bill for billions.

Open Thinking Questions

• How did deregulation contribute to the Savings and Loans crisis? • What can be learned from the crisis in terms of effective regulation and oversight? • In what ways do similar crises occur in different historical contexts?

Conclusion

The Savings and Loans crisis was a landmark moment in financial history, highlighting the importance of effective regulation and oversight. The crisis resulted in significant losses, with taxpayers footing the bill for $124 billion. By examining the mechanisms and processes involved, we can better understand the complexities of such crises and work towards preventing similar events from occurring in the future.