The Savings and Loan Crisis of 1980s

Contents

The Savings and Loan Crisis of 1980s

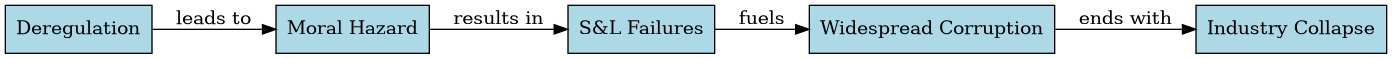

Overview In the late 1970s and early 1980s, the Savings and Loan (S&L) industry underwent significant deregulation, leading to a series of catastrophic consequences that would shake the financial world. The changes allowed S&Ls to invest in a wider range of assets, pay higher interest rates on deposits, and even issue credit cards. However, this newfound freedom also created an environment where moral hazard thrived, and many S&Ls engaged in reckless behavior, leading to widespread corruption and ultimately, the collapse of the industry.

Context The Savings and Loan industry had its roots in the 1930s, when Congress created these institutions to provide low-cost mortgages to Americans. Over time, however, they became increasingly commercialized, with S&Ls seeking to maximize profits by investing in a broader range of assets. By the late 1970s, the industry was facing significant challenges, including high inflation, rising interest rates, and increased competition from other financial institutions.

Timeline

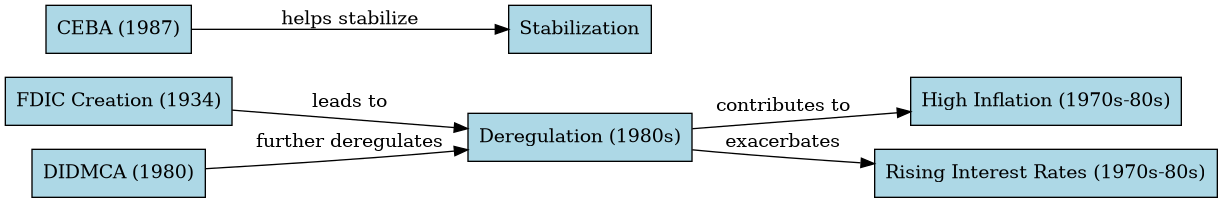

• 1934: The Federal Deposit Insurance Corporation (FDIC) is created to insure deposits at S&Ls. • 1966: Congress passes the Bank Holding Company Act, which allows S&Ls to engage in interstate banking activities. • 1970: The Supreme Court rules that S&Ls are not subject to federal anti-trust laws, paving the way for consolidation and deregulation. • 1980: The Depository Institutions Deregulation and Monetary Control Act (DIDMCA) is passed, allowing S&Ls to invest in a wider range of assets and pay higher interest rates on deposits. • 1982: The FDIC raises the maximum insured deposit amount from $40,000 to $100,000. • 1983: The first S&L failures begin to occur, with institutions such as Lincoln Savings and Loan Association engaging in reckless behavior. • 1985: Congress passes the Competitive Equality Banking Act (CEBA), which aims to address the problems plaguing the S&L industry.

Key Terms and Concepts

Deregulation

Deregulation refers to the process of removing or reducing government regulations that govern an industry. In the context of S&Ls, deregulation allowed them to engage in a wider range of activities, including investing in commercial property, stocks, and junk bonds.

Moral Hazard

Moral hazard is a term used by economists to describe the situation where individuals or institutions take on greater risk because they are protected from potential losses. In the case of S&Ls, deregulation created an environment where moral hazard thrived, leading to reckless behavior and widespread corruption.

Brokered Deposits

Brokered deposits refer to deposits made by middlemen who package and sell certificates of deposit (CDs) on behalf of S&Ls. This allowed S&Ls to raise money from a wider range of investors, including those with large sums of money.

Jumbo CDs

Jumbo CDs are certificates of deposit that exceed the maximum insured amount of $100,000. These were often sold by middlemen who packaged and sold them on behalf of S&Ls.

Savings and Loan Associations (S&Ls)

S&Ls are financial institutions that provide low-cost mortgages to Americans. They are typically owned and operated by local communities.

FDIC Insurance

FDIC insurance refers to the protection provided by the Federal Deposit Insurance Corporation (FDIC) for deposits held at S&Ls. This protects depositors up to a certain amount in case of bank failure.

Depository Institutions Deregulation and Monetary Control Act (DIDMCA)

The DIDMCA is a federal law passed in 1980 that deregulated the banking industry, including S&Ls. It allowed S&Ls to engage in a wider range of activities and pay higher interest rates on deposits.

Federal Deposit Insurance Corporation (FDIC)

The FDIC is an independent agency created by Congress in 1934 to regulate and insure deposits at S&Ls.

Key Figures and Groups

William Crawford

William Crawford was the Commissioner of the California Department of Savings and Loans who famously stated, “The best way to rob a bank is to own one.”

Lincoln Savings and Loan Association

Lincoln Savings and Loan Association was an S&L that engaged in reckless behavior, including investing in highly dubious projects and stealing from depositors.

Mechanisms and Processes

• Deregulation of S&Ls creates an environment where moral hazard thrives. • S&Ls take on greater risk by investing in a wider range of assets, including commercial property, stocks, and junk bonds. • Many S&Ls engage in reckless behavior, including stealing from depositors. • The FDIC raises the maximum insured deposit amount from $40,000 to $100,000. • Middlemen package and sell jumbo CDs on behalf of S&Ls.

Deep Background

The Savings and Loan industry has its roots in the 1930s, when Congress created these institutions to provide low-cost mortgages to Americans. Over time, however, they became increasingly commercialized, with S&Ls seeking to maximize profits by investing in a broader range of assets. By the late 1970s, the industry was facing significant challenges, including high inflation, rising interest rates, and increased competition from other financial institutions.

Explanation and Importance

The Savings and Loan crisis of the 1980s was a catastrophic event that shook the financial world. It perfectly illustrated the dangers of moral hazard, where individuals or institutions take on greater risk because they are protected from potential losses. The crisis led to widespread corruption, including theft and embezzlement, and ultimately resulted in the collapse of the S&L industry.

Comparative Insight

The Savings and Loan crisis can be compared to other financial crises, such as the 2008 housing market crash. Both events were characterized by reckless behavior, moral hazard, and a lack of regulation. However, the Savings and Loan crisis was unique in that it involved widespread corruption and theft, which ultimately led to the collapse of the industry.

Extended Analysis

- The Role of Deregulation: Deregulation played a significant role in the Savings and Loan crisis. By removing or reducing government regulations, S&Ls were able to engage in reckless behavior, including investing in highly dubious projects.

- The Impact on Depositors: The crisis had a devastating impact on depositors who lost their savings when S&Ls failed. This highlights the importance of robust regulation and oversight to protect depositors.

- The Legacy of the Crisis: The Savings and Loan crisis led to significant reforms, including the creation of new regulatory agencies and the strengthening of existing ones.

Open Thinking Questions

• How can regulators balance the need for deregulation with the need to protect depositors? • What lessons can be learned from the Savings and Loan crisis that can be applied to other financial crises? • How can we prevent similar crises in the future?

Conclusion The Savings and Loan crisis of the 1980s was a catastrophic event that shook the financial world. It perfectly illustrated the dangers of moral hazard, where individuals or institutions take on greater risk because they are protected from potential losses. The crisis highlights the importance of robust regulation and oversight to protect depositors and prevent similar crises in the future.

More posts

- The Unraveling of America's Welfare State: Hurricane Katrina and its Consequences

- The Evolution of Central Banking: A Study of the Bank of England's Development

- The First Opium War and the Cession of Hong Kong

- The Crisis of 2007-2008: A Turning Point in the Evolution of Government-Sponsored Mortgage Finance

- A Global Phenomenon: The Rise of Microfinance