The Rise of the Faulkner Property Empire

The Rise of the Faulkner Property Empire

Overview The Faulkner property empire, built by Danny Faulkner, a flamboyant developer from Garland, Texas, emerged in the late 1970s and early 1980s as a result of creative financial strategies and strategic partnerships. At its core was the company Empire Savings and Loan, which offered alluringly high interest rates on brokered deposits. This led to an influx of investments that enabled Faulkner’s rapid expansion into various property developments, including Faulkner Circle, Faulkner Creek, and Faulkner Oaks.

Context During this period, the Texas housing market was experiencing significant growth due to low interest rates and a strong economy. The 1978 Texas savings and loan deregulation bill, which allowed thrifts to invest in more complex financial instruments, created an environment conducive to aggressive growth strategies. However, this deregulation also introduced inherent risks that would eventually contribute to the collapse of several institutions.

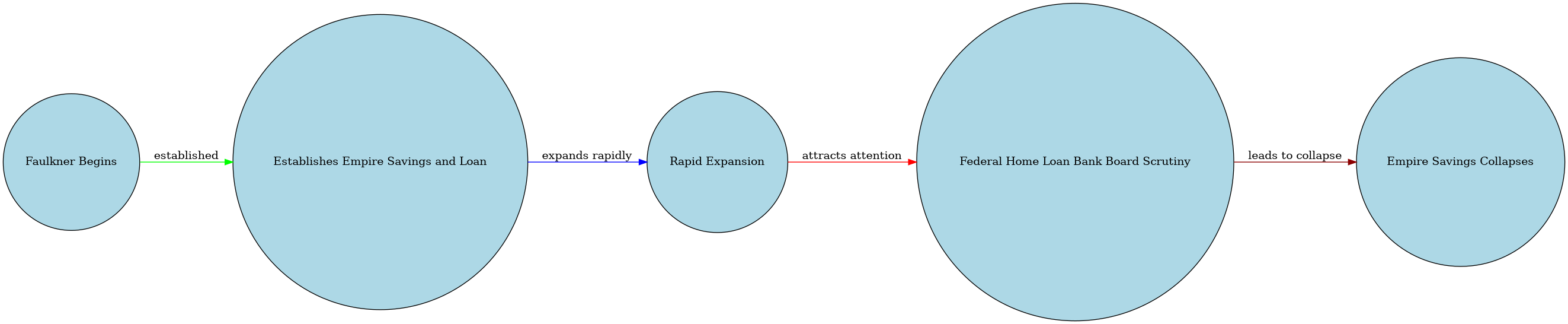

Timeline

- 1975: Danny Faulkner begins developing properties around Lake Ray Hubbard.

- 1978: Empire Savings and Loan is established with Spencer H. Blain Jr. as its chairman and James Toler, mayor of Garland, on its board.

- Early 1980s: Faulkner’s property empire expands rapidly, with new developments such as Faulkner Circle and Faulkner Creek.

- 1983: The Federal Home Loan Bank Board begins to scrutinize the activities of Empire Savings and Loan due to concerns over high-risk investments.

Key Terms and Concepts

- Brokered deposits: Deposits placed by banks or other financial institutions on behalf of their customers with thrifts like Empire Savings and Loan.

- Thrifts: Savings and loan associations, which offer savings accounts and mortgages to consumers.

- Deregulation: The removal of government regulations that restrict the activities of an industry, in this case, the Texas savings and loan deregulation bill.

Key Figures and Groups

- Danny Faulkner: A flamboyant developer from Garland who built a property empire using aggressive financial strategies.

- Spencer H. Blain Jr.: The chairman of Empire Savings and Loan, who partnered with Faulkner to build the company’s portfolio.

- James Toler: Mayor of Garland and a board member of Empire Savings and Loan.

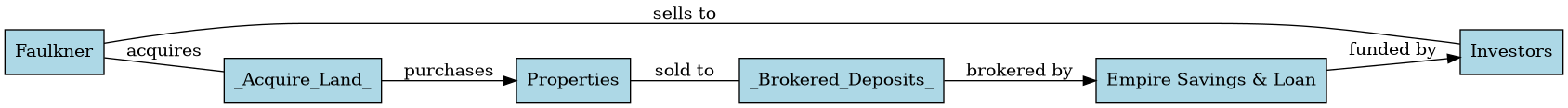

Mechanisms and Processes

-> Faulkner acquires land at low prices -> Empire Savings and Loan brokers deposits for investments in Faulkner properties -> Properties are sold to investors, who borrow money from Empire Savings and Loan

Deep Background

The Texas savings and loan industry experienced significant growth during the 1970s due to changes in federal regulations. The Home Mortgage Disclosure Act of 1975, which mandated that banks disclose their lending practices, contributed to an increase in mortgage applications and subsequently fueled the housing market.

Explanation and Importance

The rise of the Faulkner property empire highlights the risks associated with deregulation and the importance of prudent financial management. The collapse of Empire Savings and Loan in 1989, which led to a massive bailout by the federal government, serves as a cautionary tale about the dangers of unchecked risk-taking.

Comparative Insight

The experience of Empire Savings and Loan and Danny Faulkner’s property empire shares similarities with the Savings and Loan Crisis of the 1980s, where deregulation and poor management led to widespread failures. This comparison highlights the need for regulatory oversight in financial institutions.

Extended Analysis

- Aggressive Growth Strategies: Faulkner’s use of high-risk investments and aggressive land acquisition tactics exemplified a common strategy among developers during this period.

- Deregulation and Risk: The Texas savings and loan deregulation bill created an environment where thrifts like Empire Savings and Loan could engage in high-risk activities with minimal oversight.

- Consequences of Unchecked Growth: The collapse of Empire Savings and Loan resulted in significant financial losses for investors and taxpayers.

Open Thinking Questions

• What role did the deregulation of the Texas savings and loan industry play in enabling Faulkner’s aggressive growth strategies? • How did the partnerships between Faulkner, Blain Jr., and Toler facilitate the expansion of Empire Savings and Loan? • In what ways do the events surrounding Empire Savings and Loan relate to broader themes in financial history?

Conclusion The rise of the Faulkner property empire serves as a case study for the risks associated with aggressive growth strategies and deregulation. The collapse of Empire Savings and Loan highlights the importance of prudent financial management and regulatory oversight in preventing similar failures.