The Rise of Bonds: A Revolution in Finance

Contents

The Rise of Bonds: A Revolution in Finance

Overview

The creation of bonds marked a significant shift in the evolution of money and finance. Governments and large corporations began issuing bonds as a way to borrow from a broader range of people and institutions beyond banks. This development transformed the way societies accessed credit, invested, and managed debt. Bonds represent a promise by borrowers to repay principal and interest over time.

Context

In the late 18th century, European governments started issuing bonds to finance wars and public projects. The French Revolution’s Napoleonic Wars saw an increase in government borrowing through bond issues. By the mid-19th century, government debt had become a common phenomenon, with countries like Britain and France accumulating large amounts of debt.

Timeline

- 1780s: European governments begin issuing bonds to finance wars and public projects.

- 1790s: The French Revolution’s Napoleonic Wars see an increase in government borrowing through bond issues.

- 1825: British Parliament passes the Mutilation Act, allowing creditors to mutilate (cut off) notes issued by failed banks, effectively creating a market for paper securities.

- 1863: The first modern bond is issued by the U.S. government to finance the Civil War effort.

- Late 19th century: Bonds become a staple in global finance, with governments and corporations issuing them to access capital markets.

- Early 20th century: The rise of securities exchanges, such as the London Stock Exchange (LSE) and New York Stock Exchange (NYSE), facilitates bond trading and investment.

Key Terms and Concepts

- Bond: A financial instrument representing a promise by a borrower (government or corporation) to repay principal and interest over time.

- Coupon rate: The fixed interest rate paid periodically on a bond, typically expressed as an annual percentage.

- Face value: The initial amount borrowed or the principal of the loan.

- Market price: The current market value of a bond, determined by supply and demand forces.

- Yield: The return on investment earned from holding a bond, calculated based on its coupon rate and market price.

Key Figures and Groups

- Alexander Hamilton (1755-1804): American statesman who played a key role in developing the U.S. financial system, including the creation of bonds to finance the young nation’s debts.

- The Rothschild family: European banking dynasty that emerged as major bond issuers and underwriters during the 19th century.

- London Stock Exchange (LSE): One of the oldest securities exchanges in the world, facilitating bond trading since its establishment in 1801.

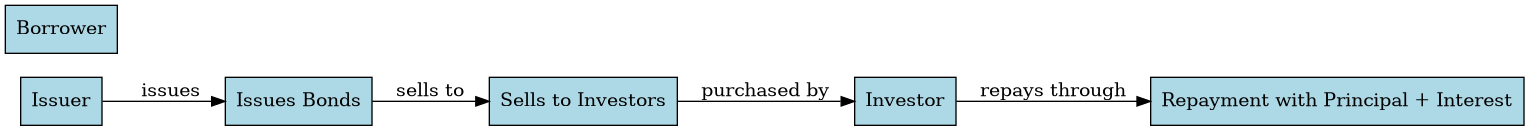

Mechanisms and Processes

Borrower → Issues bonds → Sells to investors → Repays principal + interest over time

Deep Background

The development of bonds was a response to sovereign debt crises, which plagued European nations during the late 18th century. Governments sought alternative financing mechanisms, leading to the creation of bonds as a way to access capital markets beyond traditional banking relationships.

Explanation and Importance

Bonds revolutionized finance by allowing governments and corporations to borrow from a broader range of people and institutions. This transformation had significant consequences:

- Increased access to credit: Bonds enabled borrowers to tap into larger pools of capital, reducing reliance on banks.

- Development of financial markets: The bond market grew rapidly, with securities exchanges emerging to facilitate trading and investment.

- Emergence of new financial instruments: Bonds paved the way for other financial innovations, such as derivatives and options.

Comparative Insight

The rise of bonds can be compared to the development of banknotes in the 17th century. Both innovations expanded access to credit and transformed the way societies managed debt. However, bonds offered greater flexibility and security, as they represented a promise to repay principal and interest over time.

Extended Analysis

- Bonds and Economic Growth: The creation of bonds facilitated economic growth by providing governments and corporations with access to capital markets.

- Bond Market Development: The rise of bond trading and investment led to the emergence of securities exchanges and the development of financial instruments.

- Sovereign Debt Crises: Bonds were created in response to sovereign debt crises, which plagued European nations during the late 18th century.

Open Thinking Questions

• How do bonds contribute to economic growth and stability? • What are the implications of bond market developments for governments and corporations? • In what ways have bonds influenced the evolution of financial markets and instruments?

Conclusion

The creation of bonds marked a significant shift in the evolution of money and finance. Governments and corporations began issuing bonds as a way to borrow from a broader range of people and institutions beyond banks. This development transformed the way societies accessed credit, invested, and managed debt, paving the way for further financial innovations and economic growth.