The Rise and Fall of Subprime Lending

Contents

The Rise and Fall of Subprime Lending

Overview

Subprime lending emerged as a business model in the 1990s, relying on the resale of high-risk loans to investors worldwide. This system was built upon the foundation of mainstream mortgage lending practices from the 1980s. The use of residential mortgage-backed securities (RMBS) and collateralized debt obligations (CDOs) allowed subprime lenders to package and sell these risky loans as investment-grade securities. However, this model relied on unsustainable conditions and ultimately led to widespread financial crises.

Context

The 1990s saw a significant increase in homeownership rates, particularly among low-income households. This was largely due to the introduction of new mortgage products, such as adjustable-rate mortgages (ARMs) and subprime loans. These products offered more accessible credit terms, but also carried higher interest rates and fees. The growth of securitization, which involved packaging mortgage-backed securities for resale on global markets, further fueled the expansion of subprime lending.

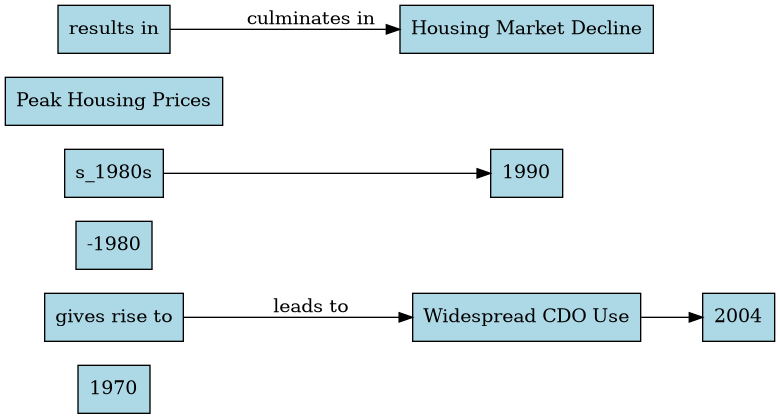

Timeline:

• 1970s-1980s: Mainstream mortgage lending practices introduce adjustable-rate mortgages (ARMs) and other non-traditional loan products. • 1990s: Subprime lenders emerge, focusing on high-risk loans to low-income borrowers. • 2001: The use of collateralized debt obligations (CDOs) becomes widespread, allowing subprime securities to be repackaged as investment-grade assets. • 2004-2006: Housing prices reach a peak, and the demand for subprime loans increases significantly. • 2007: The housing market begins to decline, leading to an increase in foreclosures and defaults on subprime loans.

Key Terms and Concepts:

- Securitization: The process of packaging mortgage-backed securities for resale on global markets.

- Residential Mortgage-Backed Securities (RMBS): Financial instruments that represent a bundle of residential mortgages, which are sold to investors as a single security.

- Collateralized Debt Obligations (CDOs): Complex financial instruments that package multiple debt obligations into a single security.

- Rating Agencies: Firms such as Moody’s and Standard & Poor’s, responsible for evaluating the creditworthiness of various securities.

- Triple-A Rated Securities: Financial instruments with the highest possible rating, indicating low risk of default.

Key Figures and Groups:

- Subprime Lenders: Companies specializing in high-risk loans to low-income borrowers. Examples include Ameriquest Mortgage Company and New Century Financial Corporation.

- Investors: Institutions and individuals purchasing subprime securities, including banks, pension funds, and hedge funds.

- Rating Agencies: Firms like Moody’s and Standard & Poor’s, responsible for evaluating the creditworthiness of subprime securities.

Mechanisms and Processes

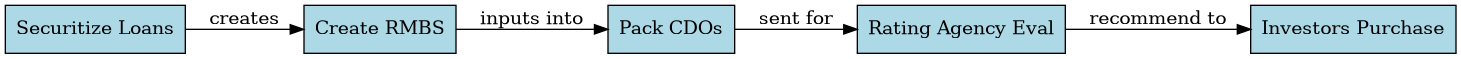

The process of creating and reselling subprime securities can be broken down into several steps:

- Originating Loans: Subprime lenders offer high-risk loans to low-income borrowers.

- Securitization: The loans are packaged into RMBS and sold to investors.

- Rating Agencies: The creditworthiness of the securities is evaluated by rating agencies, such as Moody’s or Standard & Poor’s.

- Resale: The securities are resold on global markets to investors.

Deep Background:

The expansion of subprime lending was facilitated by several long-term trends and conditions:

- Increased Homeownership Rates: As homeownership rates rose in the 1990s, there was a growing demand for mortgage products.

- Globalization of Financial Markets: The development of global financial markets allowed for the widespread resale of subprime securities.

- Lax Regulatory Environment: A lack of effective regulation and oversight enabled subprime lenders to operate with relative impunity.

Explanation and Importance:

The rise and fall of subprime lending highlights several key issues:

- Sustainability: Subprime lending relied on unsustainable conditions, including rising housing prices and low interest rates.

- Risk Management: The failure of rating agencies to accurately evaluate the creditworthiness of subprime securities contributed to the financial crisis.

- Consequences: The widespread collapse of subprime markets had far-reaching consequences, including job losses, foreclosures, and a significant decline in global economic output.

Comparative Insight:

A similar development can be observed in the Japanese property market bubble of the 1980s. Like the US subprime crisis, this episode was characterized by:

- Over-reliance on debt: Japanese banks extended large amounts of credit to real estate developers and speculators.

- Securitization: The resulting mortgage-backed securities were packaged and sold on global markets.

- Rapid collapse: When the bubble burst in 1991, Japan’s economy experienced a severe recession.

Extended Analysis:

The Role of Rating Agencies

Rating agencies played a crucial role in the subprime crisis by providing a seal of approval for investment-grade securities. However, their methods were flawed and often influenced by conflicts of interest.

The Impact on Low-Income Households

Subprime lending disproportionately affected low-income households, who were more likely to be trapped in high-interest loans and ultimately face foreclosure.

Globalization and the Financial Crisis

The widespread resale of subprime securities on global markets contributed significantly to the financial crisis. This highlights the need for greater international cooperation and regulation in the financial sector.

Open Thinking Questions:

• How do you think the subprime crisis could have been prevented or mitigated? • What role should government agencies, such as the Federal Reserve, play in regulating the financial industry? • In what ways can individuals and institutions learn from the mistakes of the past to prevent similar crises in the future?

Conclusion: The rise and fall of subprime lending serves as a cautionary tale about the dangers of unsustainable business models and the importance of effective regulation. As we continue to navigate the complexities of modern finance, it is essential to draw lessons from this episode and strive for greater transparency, accountability, and stability in the global financial system.