The Liberal Imperative: British Colonization and Investment

Contents

The Liberal Imperative: British Colonization and Investment

Overview

The Victorian era saw the imposition of distinct institutions on British colonies, designed to enhance their appeal to investors. This expansion of liberal imperialism emphasized the rule of law, non-corrupt administration, and enforceable debt contracts as essential “public goods.” These institutions not only attracted investment but also created a system where colonies with British rule were almost guaranteed against default.

Context

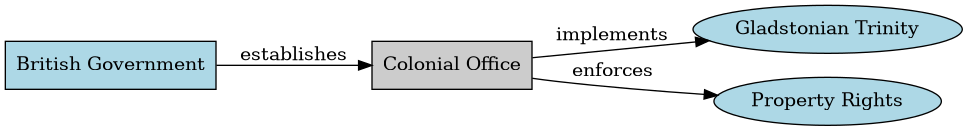

In the late 19th century, Britain’s economic interests in its colonies grew significantly. The Gladstonian trinity of sound money, balanced budgets, and free trade became the foundation for colonial administration. However, these institutions were complemented by the extension of British-style property rights and a relatively non-corrupt administration. This hybrid system created an environment where investors felt secure in lending to colonies under British rule.

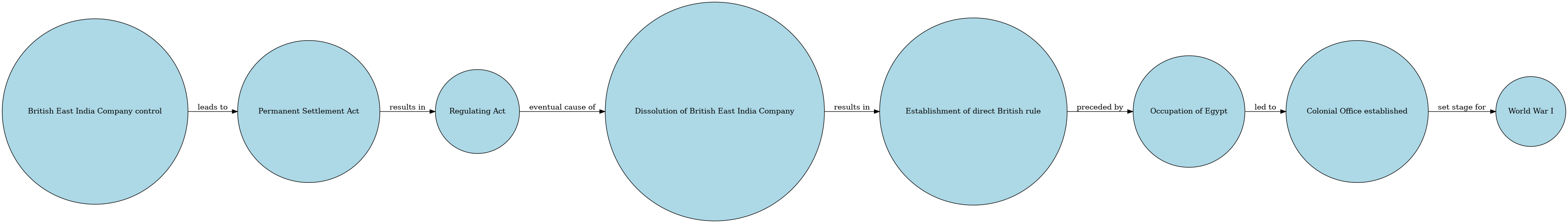

Timeline

• 1870: The British East India Company is dissolved, marking the beginning of direct British rule over Indian territories. • 1882: Britain occupies Egypt, introducing its institutions and establishing a “no default” guarantee for investors. • 1885: The Colonial Office is established to oversee the administration of colonies worldwide. • 1890s: Nationalist movements begin to emerge in various colonies, including Ireland and India. • 1901: Queen Victoria dies, marking the end of the Victorian era. • 1914: World War I breaks out, leading to a significant shift in global politics.

Key Terms and Concepts

Liberal Imperialism: A system where Western powers exerted control over non-Western territories through institutions that promoted economic development and modernization. This was often accompanied by cultural exchange and the imposition of Western values.

Gladstonian Trinity: A set of economic policies advocated by British Prime Minister William Gladstone, emphasizing sound money, balanced budgets, and free trade.

Property Rights: The extension of British-style property rights to colonies allowed for more secure investment in these territories. This included the protection of individual ownership and the enforcement of contracts.

Non-Corrupt Administration: British administrators were expected to maintain a high level of integrity, reducing the risk of corruption and ensuring that public funds were used efficiently.

Key Figures and Groups

William Gladstone: The British Prime Minister who advocated for economic reforms that emphasized sound money, balanced budgets, and free trade. His policies had a significant impact on colonial administration.

The British East India Company: A trading company that played a crucial role in the expansion of British rule over Indian territories. Its dissolution marked the beginning of direct British rule.

Nationalist Movements: Various groups emerged in colonies worldwide, demanding greater autonomy or independence from British rule. These movements posed a challenge to the liberal imperial system.

Mechanisms and Processes

The imposition of British institutions on colonies was a gradual process that involved several mechanisms: • The extension of British law to colonies created a uniform framework for property rights and contract enforcement. • Administrative reforms aimed at reducing corruption and improving governance in colonies. • Economic incentives, such as favorable trade agreements, were used to attract investment to colonies.

Deep Background

The Scramble for Africa in the late 19th century saw European powers competing for control over African territories. Britain’s response was to establish a system of colonial administration that emphasized economic development and modernization. This approach allowed for greater efficiency in governing vast territories while minimizing the need for direct military intervention.

Explanation and Importance

The liberal imperial system created an environment where investors felt secure in lending to colonies under British rule. The “no default” guarantee provided by Britain’s presence effectively eliminated the risk of default, making these investments more attractive than those in independent states. This system had significant consequences for colonial economies, as it allowed for rapid economic growth and development.

Comparative Insight

The liberal imperial system can be compared to other forms of colonization, such as French colonialism, which emphasized the spread of culture and language over economic interests. While both systems shared some similarities, they differed in their approaches to governance and administration.

Extended Analysis

Theme 1: The Rule of Law The extension of British law to colonies created a uniform framework for property rights and contract enforcement. This allowed investors to feel secure in lending to these territories, as the rule of law provided a clear mechanism for resolving disputes.

Theme 2: Economic Incentives Favorable trade agreements and economic incentives were used to attract investment to colonies. These policies encouraged growth and development by providing a stable environment for businesses to thrive.

Theme 3: Non-Corrupt Administration British administrators were expected to maintain high levels of integrity, reducing the risk of corruption and ensuring that public funds were used efficiently. This created an environment where investors felt confident in lending to colonies under British rule.

Open Thinking Questions

• How did the liberal imperial system impact colonial economies? • What were the consequences of nationalist movements emerging in various colonies? • In what ways did the “no default” guarantee provided by Britain’s presence affect investment patterns?

Conclusion

The Victorian era saw the imposition of distinct institutions on British colonies, designed to enhance their appeal to investors. The extension of British-style property rights and non-corrupt administration created an environment where investors felt secure in lending to colonies under British rule. This system had significant consequences for colonial economies, paving the way for rapid economic growth and development.

More posts

- Breaking Down the Barrier: The Swedish Riksbank and Fractional Reserve Banking

- The Rothschild Bank's Secret Role in Financing Wellington's Campaign

- The Battle of Waterloo and the Rothschild Conundrum

- The Development of Life Insurance in Scotland

- The Introduction of Hindu-Arabic Numerals and Its Impact on European Mathematics and Economy