The Illusion of Home as a Safety Net

The Illusion of Home as a Safety Net

In recent years, many families have turned to investing in their homes as a strategy for securing their financial futures. This approach relies on the assumption that property values will continue to rise, providing a cushion against unexpected expenses or a decline in income. However, this reliance on home equity as a safety net has become increasingly precarious due to shifting economic and demographic trends.

Context

The 20th century saw significant changes in the global economy, including the growth of international trade, technological advancements, and shifts in labor markets. These transformations have led to increased job insecurity, reduced social welfare programs, and rising costs for healthcare and education. In response, many families have turned to their homes as a source of financial security.

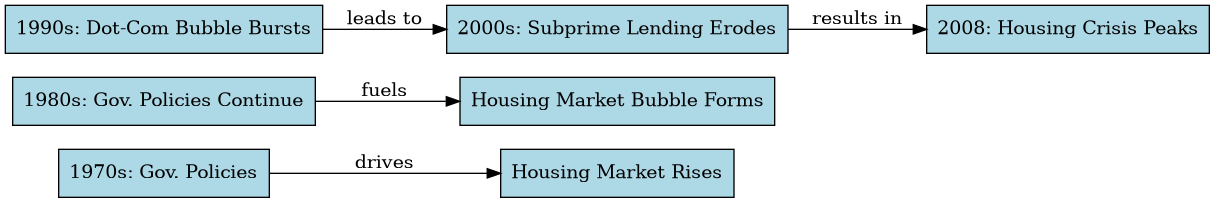

Timeline

• 1970s: Housing prices begin to rise, fueled by government policies that encourage homeownership, such as tax deductions for mortgage interest. • 1980s: The savings-and-loan crisis leads to increased borrowing and leverage in the housing market. • 1990s: The dot-com bubble bursts, causing widespread financial instability and further increasing reliance on home equity. • 2000s: Subprime lending becomes common, making it easier for borrowers to obtain mortgages with low introductory rates that eventually reset to much higher levels. • 2008: The housing market collapses, leading to a global financial crisis.

Key Terms and Concepts

- Housing Bubble: A situation in which property prices become detached from their underlying value due to speculation or excessive borrowing.

- Leverage: Using borrowed money to finance investments, such as purchasing a home with a mortgage.

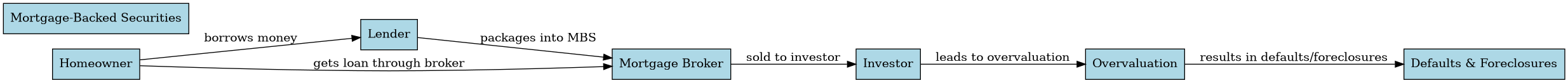

- Mortgage-Backed Securities (MBS): Financial instruments created by packaging mortgages into tradable securities that can be sold on the open market.

- Subprime Lending: Providing loans to borrowers who do not qualify for traditional credit, often at high interest rates or with unfavorable terms.

Key Figures and Groups

- Homeowners: Families who have invested in their homes as a means of securing their financial futures.

- Lenders: Financial institutions that provide mortgages to homeowners, often using complex financial instruments to manage risk.

- Government Agencies: Regulatory bodies responsible for overseeing the housing market, such as the Federal Reserve and the Department of Housing and Urban Development.

Mechanisms and Processes

Homeowners borrow money to purchase a home, which is expected to appreciate in value over time. Lenders package these mortgages into MBS, selling them on the open market to investors seeking higher returns. When property values decline, homeowners struggle to make mortgage payments, leading to defaults and foreclosures. This can trigger a cascade of events, including reduced housing prices, decreased consumer spending, and increased unemployment.

Deep Background

The concept of home as a safety net is rooted in the idea that property ownership provides a sense of security and stability. However, this notion has been influenced by various social, economic, and cultural factors over time. The post-World War II era saw an increase in homeownership rates, fueled by government policies that encouraged borrowing and investment in housing. As the global economy became more complex, families turned to their homes as a source of financial security.

Explanation and Importance

The reliance on home equity as a safety net has become increasingly precarious due to shifting economic trends. The 2008 financial crisis highlighted the dangers of over-leveraging and the instability of the housing market. As the global economy continues to evolve, it is essential to understand the complex relationships between homeownership, borrowing, and risk.

Comparative Insight

This development can be compared to other periods in history where families have turned to their homes as a source of financial security. For example, during the Great Depression, many families lost their homes due to foreclosure or bankruptcy. Similarly, in recent years, the housing market collapse has led to widespread job insecurity and reduced social welfare programs.

Extended Analysis

- The Role of Government Policy: Government policies have played a significant role in shaping the housing market and influencing homeownership rates.

- The Impact on Vulnerable Populations: The reliance on home equity as a safety net disproportionately affects vulnerable populations, such as low-income families and minority communities.

- Long-Term Consequences: The current trend of turning to home equity as a source of financial security may have long-term consequences for the economy and society.

Open Thinking Questions

• What are the potential risks associated with relying on home equity as a safety net? • How do government policies influence homeownership rates and the housing market? • What alternative strategies can families use to secure their financial futures?

Conclusion

The reliance on home equity as a safety net is a complex issue that requires careful consideration of historical, economic, and social factors. As the global economy continues to evolve, it is essential to understand the risks and consequences associated with this trend and to explore alternative strategies for securing financial stability.

More posts

- Property-Owning Democracies: A Global Phenomenon

- The Decline of Fiat Currency: A Historical Perspective

- The 1923 German Hyperinflation: A Complex Consequence of Domestic and International Factors

- The Rise and Fall of John Law's Financial Empire

- The Rise and Fall of William Law: A Study in 17th-Century Scottish Aristocracy