The Enron Scandal: A Turning Point in Corporate Governance

Contents

The Enron Scandal: A Turning Point in Corporate Governance

Overview

In August 2001, Kenneth Lay’s resignation from Enron Corporation sparked a chain reaction that led to one of the most significant corporate scandals in history. The company’s stock price plummeted, and its financial woes were soon exposed, revealing widespread accounting manipulation and corporate malfeasance. This explanation examines the events leading up to the scandal, its consequences, and the broader implications for corporate governance.

Context

The late 1990s and early 2000s saw a period of rapid growth in the energy sector, driven by deregulation and increased demand for electricity. Enron, under the leadership of Kenneth Lay and Jeffrey Skilling, was at the forefront of this expansion, using complex financial instruments to take advantage of market fluctuations. However, as the company’s aggressive business model began to unravel, its executives resorted to increasingly desperate measures to maintain the illusion of profitability.

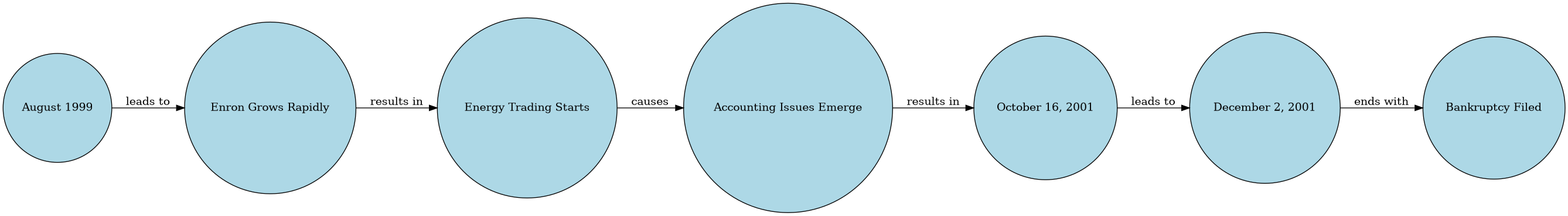

Timeline

- 1999: Enron begins to aggressively expand into the energy market through a series of acquisitions and partnerships.

- 2000: The company’s stock price peaks at $90.37, and investors are assured that it will soon reach $100.

- August 14, 2001: Jeffrey Skilling unexpectedly announces his resignation from the company due to “personal reasons.”

- August 2001: Sherron Watkins sends a memo to Kenneth Lay expressing her concerns about Enron’s accounting practices.

- October 16, 2001: Enron reports a $618 million third-quarter loss and a $1.2 billion reduction in shareholder equity.

- October 24, 2001: Fastow steps down as CFO amidst growing scrutiny from the SEC.

- November 8, 2001: Enron revises its profits for the preceding five years, revealing an overstatement of $567 million.

- December 2, 2001: Enron files for bankruptcy protection.

Key Terms and Concepts

Enron’s Aggressive Business Model: This refers to the company’s use of complex financial instruments to take advantage of market fluctuations. Enron’s executives believed that by using derivatives and other financial tools, they could create a stable revenue stream while minimizing risk.

Mark-to-Market Accounting: This accounting method allows companies to value their assets at current market prices rather than historical costs. Critics argue that this approach can lead to inflated asset values and conceal underlying financial weaknesses.

Off-Balance-Sheet Entities: These are subsidiaries or affiliates that are not consolidated on a company’s balance sheet, allowing executives to hide liabilities and inflate earnings.

Key Figures and Groups

- Jeffrey Skilling: Enron CEO who resigned in August 2001 due to “personal reasons.”

- Kenneth Lay: Enron Chairman of the Board who was ultimately held responsible for the company’s collapse.

- Sherron Watkins: Enron employee who sent a memo to Kenneth Lay expressing her concerns about accounting practices.

- Andrew Fastow: Enron CFO who was forced to resign in October 2001 amidst growing scrutiny from the SEC.

Mechanisms and Processes

→ As Enron’s stock price began to decline, executives resorted to increasingly desperate measures to maintain the illusion of profitability. This included using off-balance-sheet entities to hide liabilities and inflate earnings. → The company’s aggressive business model, which relied on complex financial instruments, became increasingly unstable as market conditions changed. → Despite growing concerns from employees like Sherron Watkins, Enron executives continued to prioritize short-term gains over long-term sustainability.

Deep Background

The Enron scandal was not an isolated incident but rather the culmination of a broader trend towards corporate malfeasance in the late 1990s and early 2000s. The Sarbanes-Oxley Act of 2002, passed in response to the Enron scandal, aimed to strengthen corporate governance by requiring greater transparency and accountability from executives.

Explanation and Importance

The Enron scandal marked a turning point in corporate governance, highlighting the need for stronger regulations and greater accountability from executives. The consequences of the scandal were far-reaching, leading to widespread job losses, financial devastation for investors, and a re-evaluation of the role of corporate governance in ensuring long-term sustainability.

Comparative Insight

The Enron scandal can be compared with other high-profile corporate scandals, such as the collapse of Lehman Brothers in 2008. Both incidents highlight the dangers of unchecked executive power and the importance of robust regulatory oversight.

Extended Analysis

The Role of Executive Compensation: The Enron scandal highlights the need for more effective regulation of executive compensation packages. Excessive bonuses and stock options can create a culture of risk-taking, as executives prioritize short-term gains over long-term sustainability.

The Importance of Independent Oversight: Enron’s board of directors failed to exercise adequate oversight, allowing executives to engage in reckless behavior. This highlights the need for more effective independent oversight mechanisms to prevent similar scandals in the future.

The Impact on Investor Confidence: The Enron scandal led to a significant erosion of investor confidence in the corporate sector. This had far-reaching consequences, including reduced investment and increased scrutiny from regulators.

Open Thinking Questions

• What role did the Sarbanes-Oxley Act play in preventing similar scandals in the years following Enron? • How can companies balance the need for executive compensation with the risks associated with excessive bonuses and stock options? • What lessons can be drawn from the Enron scandal regarding the importance of independent oversight and robust regulatory oversight?

Conclusion

The Enron scandal marked a significant turning point in corporate governance, highlighting the need for stronger regulations, greater accountability from executives, and more effective independent oversight. As the financial sector continues to evolve, it is essential to learn from the mistakes of the past and prioritize long-term sustainability over short-term gains.