The Emergence of Credit: Ancient Foundations

Contents

The Emergence of Credit: Ancient Foundations

Overview

In ancient Mesopotamia, a fundamental concept that would shape the course of human history began to take form – credit. While it’s not accurate to say that credit was invented in this period, these early transactions laid the groundwork for modern economic systems. The development of borrowing and lending between individuals, royal storehouses, and religious institutions would eventually give rise to complex global economies.

Context

During the 3rd millennium BCE, Mesopotamia, situated between the Tigris and Euphrates rivers in present-day Iraq, was a hub of urban civilization. The region’s strategic location facilitated trade with neighboring cities and empires, fostering economic growth and cultural exchange. As populations grew and societies became more complex, the need for financial mechanisms to facilitate transactions increased.

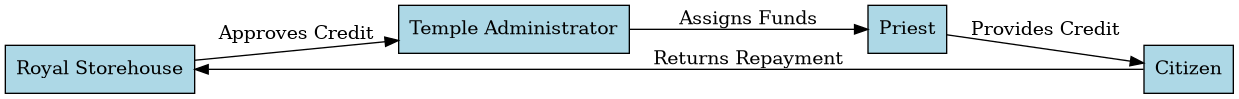

The Royal Storehouses played a crucial role in managing grain reserves and providing loans to citizens during times of famine or hardship. These storehouses were often affiliated with temples, highlighting the close relationship between religion and economic activities in Mesopotamia. The concept of credit, although not yet sophisticated, began to emerge as people borrowed from these institutions.

Timeline

• 3500 BCE: Emergence of urban civilizations in Mesopotamia, marked by the development of temples, palaces, and administrative centers. • 3000 BCE: Royal storehouses become a central feature of Mesopotamian cities, managing grain reserves and providing loans to citizens. • 2500 BCE: Trade networks expand across Mesopotamia, facilitating exchange between cities and regions. • 2300 BCE: Temple-based economies gain prominence, with priests and temple administrators assuming roles in managing finances and trade. • 2000 BCE: Early forms of scribal accounting emerge, allowing for more complex financial transactions.

Key Terms and Concepts

Credit

The provision of funds or resources to individuals or organizations, often with the expectation of future repayment or return on investment. In ancient Mesopotamia, credit was initially limited to simple advances from royal or religious storehouses.

Royal Storehouses

Centralized institutions responsible for managing grain reserves and providing loans to citizens during times of need.

Religion

Played a significant role in shaping economic activities in Mesopotamia, with temples serving as centers of finance, trade, and social welfare.

Scribal Accounting

Early forms of written record-keeping that allowed for more complex financial transactions and the development of sophisticated credit systems.

Key Figures and Groups

- **Sargon of Akkad: Unified Mesopotamia under a single government, facilitating trade and economic growth.

- The Royal Scribes: Developed advanced scribal accounting techniques, enabling more complex financial transactions.

- Temple Priests: Managed temple-based economies, overseeing finances and trade activities.

Mechanisms and Processes

→ The emergence of royal storehouses led to the development of credit systems → Trade networks expanded across Mesopotamia → Temple-based economies gained prominence → Early forms of scribal accounting emerged →

Deep Background

The concept of credit in ancient Mesopotamia was closely tied to the social and economic structures of the time. The patron-client relationship, where wealthy patrons supported artisans and traders, played a significant role in shaping credit systems.

In this context, debt served as a means of maintaining social relationships and ensuring economic stability. Borrowers often repaid debts through labor or goods, rather than cash, highlighting the importance of reciprocity in ancient Mesopotamian society.

Explanation and Importance

The emergence of credit in ancient Mesopotamia laid the groundwork for modern economies. As trade networks expanded and temple-based economies grew, the need for complex financial mechanisms increased. The development of scribal accounting enabled more sophisticated credit systems, facilitating economic growth and cultural exchange.

Comparative Insight

In comparison to other ancient civilizations, such as Ancient Egypt or The Indus Valley Civilization, Mesopotamia’s emphasis on temple-based economies and scribal accounting facilitated the emergence of more complex credit systems. These developments allowed for greater economic specialization and trade, contributing to the growth and prosperity of Mesopotamian cities.

Extended Analysis

Sub-theme 1: The Role of Royal Storehouses

Royal storehouses played a crucial role in managing grain reserves and providing loans to citizens during times of need. This system allowed for the emergence of credit systems, which would eventually become a cornerstone of modern economies.

Sub-theme 2: Temple-Based Economies

Temple-based economies gained prominence in Mesopotamia, with priests and temple administrators assuming roles in managing finances and trade. These institutions facilitated economic growth by providing loans to artisans and traders.

Sub-theme 3: Scribal Accounting

Early forms of scribal accounting emerged in Mesopotamia, enabling more complex financial transactions and the development of sophisticated credit systems. This innovation allowed for greater economic specialization and trade, contributing to the growth and prosperity of Mesopotamian cities.

Open Thinking Questions

• What were the primary factors that contributed to the emergence of credit in ancient Mesopotamia? • How did temple-based economies shape the development of credit systems? • What role did scribal accounting play in facilitating economic growth and cultural exchange?

Conclusion

The emergence of credit in ancient Mesopotamia marked a crucial turning point in human history. As trade networks expanded, temple-based economies gained prominence, and scribal accounting developed, the stage was set for the growth and prosperity of modern economies. This foundation has continued to shape global economic systems, highlighting the enduring importance of credit as a fundamental concept in our world today.