The Development of John Law's Financial System

Contents

The Development of John Law’s Financial System

Overview John Law’s System was a comprehensive plan to reform the French economy, which aimed to address the country’s financial crisis through the expansion of credit and the reorganization of public debt. Reflation, a modern term describing an increase in the money supply to stimulate economic growth, is an apt description of Law’s strategy. This system, implemented between 1716 and 1720, had far-reaching consequences for France and its people.

Context In the early 18th century, France was facing significant financial difficulties due to a combination of factors, including public debt, which had grown exponentially since the reign of Louis XIV. The French economy was also plagued by inflation, trade deficits, and a lack of confidence in the government’s ability to manage its finances.

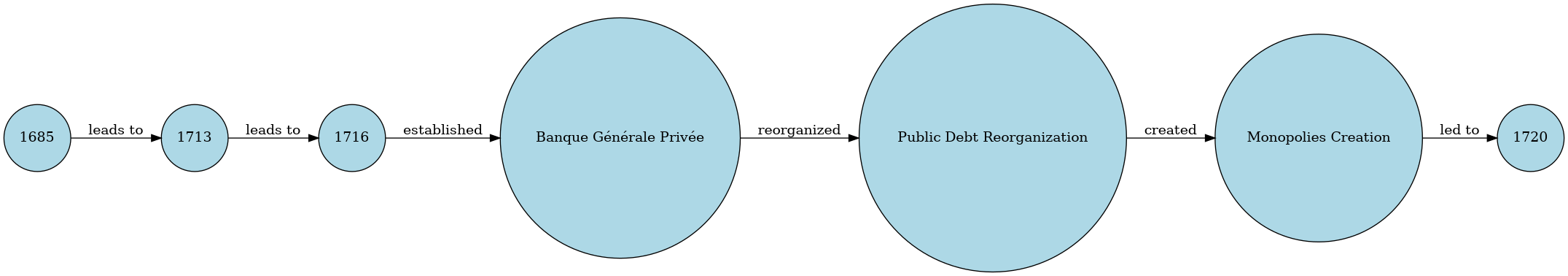

Timeline

• 1685: Louis XIV establishes the Banque Générale, a precursor to modern central banking institutions. • 1713: France suffers significant losses during the War of the Spanish Succession, leading to increased public debt and economic instability. • 1716: John Law arrives in Paris and begins to develop his financial system. • 1717: The Banque Générale Privée is founded, with Law at its helm, to provide credit to the French government and stimulate economic growth. • 1720: Law’s System reaches its peak, but it ultimately collapses due to a combination of factors, including speculation, corruption, and external pressures.

Key Terms and Concepts

- Reflation: An increase in the money supply to stimulate economic growth.

- Public debt: The total amount of debt owed by the government to creditors.

- Banque Générale Privée: A private bank founded by Law to provide credit to the French government and stimulate economic growth.

- Monopolies: Exclusive rights granted to companies or individuals to trade in specific goods or services.

- Credit system: A network of financial institutions that facilitate borrowing and lending.

Key Figures and Groups

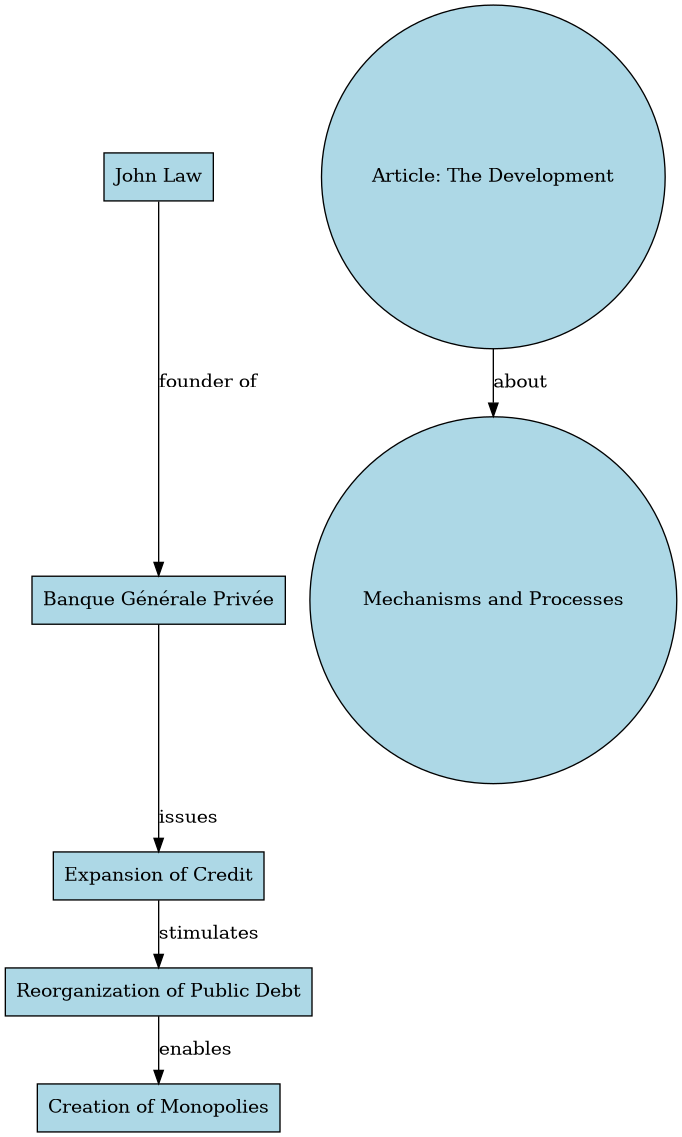

- John Law: A Scottish economist who developed the financial system implemented between 1716 and 1720. His system was designed to address France’s financial crisis through reflation and the reorganization of public debt.

- The French Monarchy: The ruling family of France, which faced significant financial difficulties in the early 18th century.

- The nobility: A powerful social class that dominated French society during this period. They played a significant role in shaping the country’s economic policies.

Mechanisms and Processes

- Law’s System was built on several key mechanisms:

- The expansion of credit through the Banque Générale Privée.

- The reorganization of public debt into equity held by the company.

- The creation of monopolies to generate revenue for the government.

- These mechanisms were designed to work together to stimulate economic growth and address France’s financial crisis:

- The expansion of credit would increase liquidity in the economy, stimulating trade and investment.

- The reorganization of public debt would reduce the burden on the French monarchy and provide a new source of revenue through dividend payments.

- The creation of monopolies would generate revenue for the government through exclusive rights to trade in specific goods or services.

Deep Background

The financial difficulties faced by France in the early 18th century were a result of several long-term trends, including:

- The growth of public debt: Since the reign of Louis XIV, France had accumulated significant debt, which had become increasingly burdensome.

- Inflation and trade deficits: The French economy was plagued by inflation, trade deficits, and a lack of confidence in the government’s ability to manage its finances.

Explanation and Importance

Law’s System was an attempt to address these issues through reflation and the reorganization of public debt. While it provided a much-needed stimulus to the French economy, it ultimately collapsed due to a combination of factors, including speculation, corruption, and external pressures. The collapse of Law’s System had significant consequences for France, including:

- Financial crisis: The collapse of the system led to a severe financial crisis, which took decades to recover from.

- Loss of confidence: The failure of Law’s System eroded trust in the French government’s ability to manage its finances and stimulate economic growth.

Comparative Insight

Law’s System can be compared to other financial systems developed during this period, such as the South Sea Company in England. Both systems shared similarities, including:

- Monopolies: Both systems created monopolies to generate revenue for the government.

- Credit expansion: Both systems expanded credit to stimulate economic growth.

However, there were also significant differences between the two systems, including:

- Scope: Law’s System was designed to address France’s financial crisis, while the South Sea Company focused on stimulating trade and investment in England.

Extended Analysis

The Role of Speculation

Speculation played a significant role in the collapse of Law’s System. As prices for shares in the company rose, speculators began to buy up shares in anticipation of further price increases. This led to:

- Inflation: The rapid increase in share prices led to inflation, as money became less valuable.

- Crash: When the system collapsed, share prices plummeted, leading to a severe financial crisis.

The Impact on Social Class

Law’s System had significant implications for social class in France. The creation of monopolies and exclusive rights to trade in specific goods or services benefited the nobility and wealthy merchants, while exacerbating poverty among the lower classes.

Open Thinking Questions

- How did Law’s System reflect the broader economic trends of the early 18th century?

- What were the long-term consequences of the collapse of Law’s System for France and its people?

- In what ways did Law’s System contribute to the growth of monopolies and exclusive rights in France?

Conclusion Law’s System was a complex and ambitious plan to reform the French economy. While it provided a much-needed stimulus, it ultimately collapsed due to a combination of factors, including speculation, corruption, and external pressures. The collapse of Law’s System had significant consequences for France, including financial crisis, loss of confidence, and exacerbation of social inequality.

More posts

- The Rise and Fall of the Dutch East India Company

- The Challenge of Uncertainty: Understanding the Role of the State and Individual Response

- China's Rise and the Shift in Global Capital Flows

- The Rise of Condottieri: The Mercenary System in 14th-Century Italy

- The Evolution of Credit and Debt: Ancient Mesopotamia's Lending System