The Crisis of the British Welfare State

The Crisis of the British Welfare State

Overview The British welfare state, established after World War II, had become a source of concern for conservatives in Britain by the 1980s. Critics argued that the system of national insurance had degenerated into a system of state handouts and confiscatory taxation, which was severely skewing economic incentives. The rise of social transfers from 2.2% of GDP in 1930 to nearly 17% in 1980 had significant consequences for the British economy.

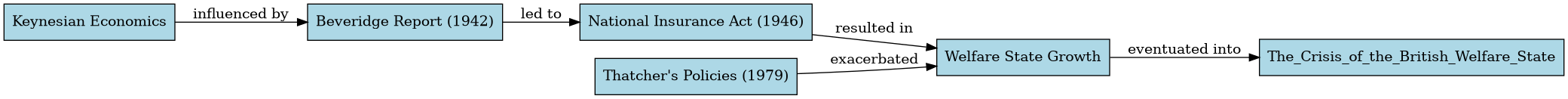

Context The post-war period saw rapid growth in government spending on welfare programs, which was driven by a combination of factors. Keynesian economics, which emphasized government intervention in the economy to stabilize output and employment, gained popularity among policymakers. Additionally, the Beveridge Report (1942) and the National Insurance Act (1946) introduced a comprehensive system of social security benefits and national insurance contributions.

The welfare state was designed to provide a safety net for citizens and promote economic growth through increased consumption. However, by the 1980s, critics began to argue that the system had become too burdensome on taxpayers and stifled economic incentives. The Margaret Thatcher government’s policies aimed to reduce the role of the state in the economy and promote private sector growth.

Timeline

- 1930: Social transfers account for just 2.2% of GDP

- 1942: The Beveridge Report is published, recommending a comprehensive system of social security benefits

- 1946: The National Insurance Act introduces national insurance contributions and social security benefits

- 1960: Social transfers rise to 10% of GDP

- 1970: Social transfers reach 13% of GDP

- 1980: Social transfers nearly 17% of GDP, with expenditure on health care, social services, and social security consuming three times more than defense

Key Terms and Concepts

- National Insurance: A system of contributions and benefits introduced in the UK to provide a safety net for citizens

- Beveridge Report: A 1942 report that recommended a comprehensive system of social security benefits

- Keynesian economics: An economic theory that emphasizes government intervention in the economy to stabilize output and employment

- Marginal tax rates: The rate at which taxes are levied on additional income or capital gains

Key Figures and Groups

- Margaret Thatcher: British Prime Minister who implemented policies aimed at reducing the role of the state in the economy

- William Beveridge: Author of the 1942 report that recommended a comprehensive system of social security benefits

- British trade unions: Organizations that represent workers’ interests in collective bargaining and industrial relations

- Business community: A group of employers, entrepreneurs, and investors who advocated for policies to promote economic growth and private sector development

Mechanisms and Processes

→ National insurance contributions → Social security benefits → Increased government expenditure on welfare programs → Skewed economic incentives → Stagnant growth and high inflation (stagflation)

Deep Background The rise of social transfers in Britain was a long-term trend that can be understood within the context of post-war economic policies. The post-war settlement, which included full employment, a comprehensive system of social security benefits, and increased government expenditure on welfare programs, was designed to promote economic growth and social stability.

However, by the 1980s, critics began to argue that this system had become too burdensome on taxpayers and stifled economic incentives. The oil price shocks of the 1970s and the subsequent economic downturn further exacerbated these problems.

Explanation and Importance The crisis of the British welfare state was a complex issue that involved economic, social, and political factors. The rise of social transfers had significant consequences for the British economy, including stagnant growth and high inflation (stagflation). The Thatcher government’s policies, which aimed to reduce the role of the state in the economy and promote private sector growth, were a response to these problems.

Comparative Insight The crisis of the British welfare state can be compared with similar developments in other countries. For example, the United States experienced a similar rise in social transfers from 4% of GDP in 1959 to 9% in 1975, outstripping defense spending for the first time. This highlights the global nature of these issues and the need for comparative analysis.

Extended Analysis

- The role of trade unions: The British trade unions played a significant role in shaping the crisis of the welfare state. Their “go slows” and other industrial actions contributed to stagnant growth and high inflation.

- The impact on productivity: The rise of social transfers had a negative impact on productivity, which grew by just 2.8% between 1960 and 1979 compared with 8.1% in Japan.

- The Thatcher government’s response: The Thatcher government’s policies aimed to reduce the role of the state in the economy and promote private sector growth.

Open Thinking Questions

• What are the implications of a rising welfare state for economic growth and social stability? • How can policymakers balance the need for social security benefits with the need to promote economic incentives? • What lessons can be drawn from the crisis of the British welfare state for other countries facing similar challenges?

Conclusion The crisis of the British welfare state was a complex issue that involved economic, social, and political factors. The rise of social transfers had significant consequences for the British economy, including stagnant growth and high inflation (stagflation). The Thatcher government’s policies aimed to reduce the role of the state in the economy and promote private sector growth. This moment represents a critical turning point in the development of the British welfare state and highlights the need for policymakers to balance social security benefits with economic incentives.