The British Consol: A Bonding Force in 18th Century Finance

Contents

The British Consol: A Bonding Force in 18th Century Finance

Overview The British consol was a type of government bond issued by the British government from the late 18th century onwards. It was notable for its high return on investment, particularly through its perpetual bond structure and two coupon options: 3% and 5%. This financial instrument played a significant role in financing Britain’s war efforts and economic development.

Context By the late 18th century, the British government faced significant expenses from ongoing military campaigns, particularly the Seven Years’ War (1756-1763) and the American Revolutionary War (1775-1783). To finance these endeavors, the government turned to issuing bonds, which allowed it to borrow money from investors in exchange for interest payments. The creation of the consol bond was a response to this need.

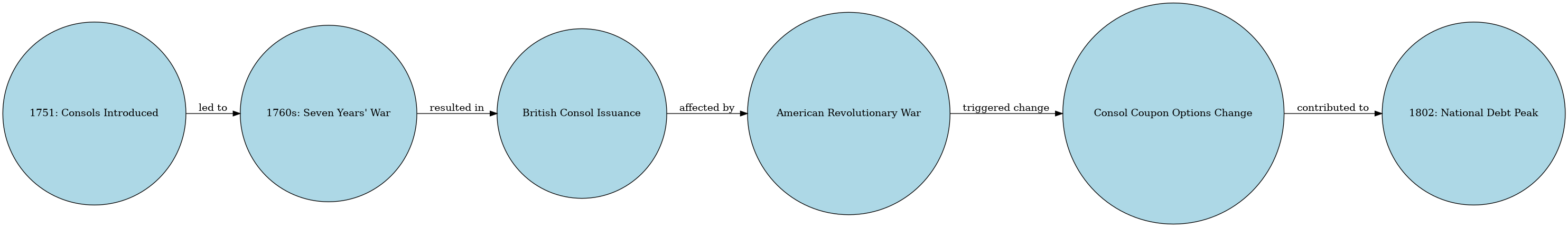

Timeline

- 1751: Britain issues its first perpetual bonds, known as consols, with an initial face value of £3 million.

- 1760s: Consols become a popular investment option among British citizens and foreign investors.

- Late 18th century: The government introduces the 3% and 5% coupon options to attract more investors.

- 1802: Britain’s national debt reaches its peak, with consol bonds making up a significant portion of this debt.

- Early 19th century: Consols remain a staple of British finance, but their popularity begins to wane due to changes in government policies and economic conditions.

Key Terms and Concepts

Perpetual Bond: A type of bond that does not have a fixed maturity date. The issuer can redeem the bond at any time, but this is typically done only when its market price equals or exceeds its face value.

Coupon: A payment made by the issuer to the investor in exchange for holding the bond. In this case, there were two options: 3% and 5%.

Consol Bond: A specific type of perpetual bond issued by the British government from the late 18th century onwards.

Face Value (Par): The initial value of the bond when it was purchased by the investor.

Market Price: The current trading price of the bond on the market.

Investor’s Name and Date: Information included in the consol receipt, specifying the individual who purchased the bond and the date of purchase.

Key Figures and Groups

The British Government: Issued the consols to finance its war efforts and economic development. The government’s financial needs led to the creation of this innovative financial instrument.

Investors: Individuals, institutions, and foreign governments that bought consol bonds in exchange for interest payments. They played a crucial role in financing Britain’s military campaigns and economic growth.

Financial Institutions: Banks, merchants, and other financial organizations that facilitated the sale and trading of consols on the market.

Mechanisms and Processes

The creation and issuance of consols involved several steps:

- Government Decision: The British government decides to issue consol bonds to finance its war efforts and economic development.

- Bond Creation: Perpetual bonds are created with two coupon options: 3% and 5%.

- Sale and Trading: Consols are sold to investors on the market, who can buy back the bond at any time if its market price equals or exceeds its face value.

Deep Background

To understand the significance of consol bonds in British finance, it is essential to consider the broader economic and financial context of 18th century Britain. At this time, the country was experiencing a period of rapid growth, driven by industrialization and colonial expansion. However, these developments also led to significant government spending on military campaigns, infrastructure projects, and other initiatives.

Explanation and Importance

The consol bond played a vital role in financing Britain’s war efforts and economic development during the 18th century. Its success can be attributed to its innovative perpetual structure and two coupon options, which attracted investors from various backgrounds. The government’s ability to issue these bonds was crucial for funding military campaigns, infrastructure projects, and other initiatives.

Comparative Insight

While the consol bond was unique to British finance, other countries also issued similar perpetual bonds during this period. For instance, France introduced its own perpetual bond system in the late 18th century. This comparison highlights the global nature of financial innovation and the importance of understanding the historical context in which economic systems developed.

Extended Analysis

Government Revenue and Debt Management

The consol bond was a key component of Britain’s debt management strategy during the 18th century. The government used these bonds to finance its spending, while also managing its national debt. This dual role highlights the complexities of public finance and the need for governments to balance revenue generation with debt management.

Financial Markets and Institutions

The consol bond helped establish London as a major financial hub during the 18th century. The creation of this innovative financial instrument facilitated the development of financial markets and institutions, including banks, merchants, and other organizations that specialized in trading consols on the market.

Investor Participation and Risk Management

The consol bond’s popularity among investors can be attributed to its relatively low risk profile compared to other investments. The perpetual structure and two coupon options made it an attractive option for those seeking a stable return on investment.

Economic Impact and Consequences

The widespread adoption of consols had significant economic implications, both positive and negative. On the one hand, they helped finance Britain’s war efforts and economic development, contributing to its emergence as a global superpower. However, the government’s reliance on consols also led to concerns about national debt and the need for effective debt management strategies.

Open Thinking Questions

- What were the key factors driving the creation of the consol bond in 18th century Britain?

- How did the consol bond contribute to Britain’s economic growth and development during this period?

- What lessons can be drawn from the British experience with consols regarding modern-day debt management strategies?

Conclusion The British consol was a groundbreaking financial instrument that played a crucial role in financing Britain’s war efforts and economic development during the 18th century. Its innovative perpetual structure and two coupon options made it an attractive option for investors, while its significance extends to the broader context of public finance, financial markets, and investor participation.