Fiscal Policy in the United States: A Study of Budget Deficits and Bond Market Reactions

Contents

Fiscal Policy in the United States: A Study of Budget Deficits and Bond Market Reactions

Overview The Bush administration’s fiscal policies have been marked by significant budget deficits and a growing federal debt. Despite these concerns, the bond market has responded positively to the administration’s actions. This study examines the historical context of the federal budget and its impact on the bond market.

Context In the late 20th century, the United States experienced a period of economic growth and prosperity. However, this growth was accompanied by rising government spending and increasing deficits. The federal budget deficit, which measures the difference between government revenues and expenditures, has been a persistent issue for several decades. The federal debt, or the total amount owed by the government to its creditors, has also grown significantly.

Timeline

• 1980s: Federal budget deficits become a major concern as the national debt increases from $994 billion in 1980 to $2.7 trillion in 1988. • 1993: The Omnibus Budget Reconciliation Act is passed, reducing the deficit and increasing taxes. • 2001: President George W. Bush takes office and submits his first budget, which includes significant tax cuts and increased spending. • 2002: The federal debt reaches $6 trillion for the first time in history. • 2003: The Congressional Budget Office forecasts a continued rise in the federal debt to more than $9 trillion by 2017. • 2005: The federal budget deficit exceeds $400 billion, the highest level since World War II. • 2008: The financial crisis leads to a significant decline in government revenues and an increase in spending.

Key Terms and Concepts

Federal Budget Deficit: The difference between government revenues and expenditures. A persistent budget deficit can lead to an increase in the federal debt.

Federal Debt: The total amount owed by the government to its creditors. The debt is composed of outstanding bonds, bills, and notes issued by the government.

Bond Market: The market where investors buy and sell government securities, such as Treasury bonds.

Yield: The rate of return on a bond, expressed as a percentage. A lower yield indicates that investors are willing to accept a lower rate of return for holding the bond.

Key Figures and Groups

George W. Bush: The 43rd President of the United States, who submitted several budgets that included significant tax cuts and increased spending.

Congressional Budget Office (CBO): A non-partisan agency responsible for forecasting government revenues and expenditures.

Federal Reserve: An independent agency responsible for monetary policy, including setting interest rates.

Mechanisms and Processes

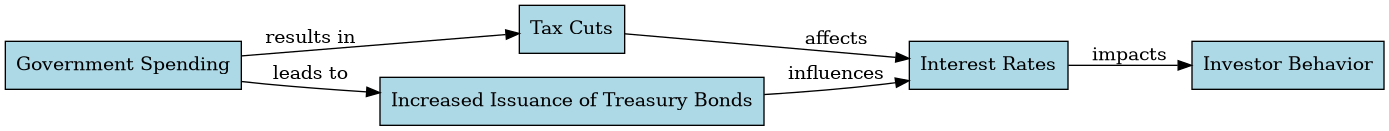

The bond market’s response to the federal budget deficit can be broken down into several steps:

- Government Spending: The administration submits a budget that includes increased spending.

- Tax Cuts: The administration passes tax cuts, which reduce government revenues.

- Budget Deficit: The resulting difference between government revenues and expenditures is the budget deficit.

- Federal Debt: The deficit is financed by issuing new bonds, bills, and notes, which increase the federal debt.

Deep Background

The United States has a long history of budget deficits and debt accumulation. However, it was not until the 1980s that these issues became major concerns. Several factors contributed to this trend:

- World War II: The massive government spending during World War II led to a significant increase in the federal debt.

- Post-War Economic Growth: The post-war period saw rapid economic growth, which was fueled by government spending and tax cuts.

- Monetary Policy: The Federal Reserve’s monetary policies, including low interest rates, contributed to the growth of government borrowing.

Explanation and Importance

The bond market’s response to the federal budget deficit is a critical issue for policymakers. A persistent budget deficit can lead to an increase in the federal debt, which can have significant consequences:

- Increased Debt: The increased debt burden can limit government flexibility and increase interest payments.

- Inflation: Excessive borrowing can lead to inflation, as the increased money supply reduces the value of the currency.

Comparative Insight

The United States’ experience with budget deficits and bond market reactions is not unique. Several other countries have faced similar challenges:

- Japan: Japan’s experience with budget deficits and debt accumulation has been particularly notable.

- European Union: The EU’s fiscal policies, including the Stability and Growth Pact, aim to prevent excessive budget deficits.

Extended Analysis

Fiscal Policy and Economic Growth

The relationship between government spending and economic growth is complex. Some argue that increased government spending can stimulate economic growth, while others claim that it can lead to inflation and decreased productivity.

Monetary Policy and Fiscal Policy

The interaction between monetary policy and fiscal policy is critical in determining the bond market’s response to budget deficits. Central banks’ interest rate decisions can influence the attractiveness of government bonds to investors.

Global Economic Trends

The global economic landscape has undergone significant changes in recent decades, including:

- Increased Globalization: Trade and investment have increased significantly, leading to a more interconnected world economy.

- Emerging Markets: The rise of emerging markets, such as China and India, has changed the global economic balance.

Open Thinking Questions

• How do you think policymakers can balance government spending with the need for fiscal responsibility? • What are the potential consequences of a continued rise in the federal debt? • Can other countries’ experiences inform U.S. policy decisions on budget deficits and bond market reactions?

Conclusion The Bush administration’s fiscal policies have been marked by significant budget deficits and a growing federal debt. Despite these concerns, the bond market has responded positively to the administration’s actions. Understanding this complex issue requires examining the historical context of the federal budget and its impact on the bond market.