Financial Alchemy in 18th Century France

Financial Alchemy in 18th Century France

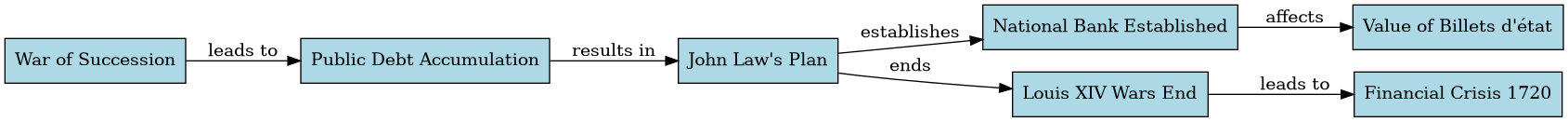

Overview In the early 18th century, France was facing a severe financial crisis due to its accumulated public debt from the wars of Louis XIV. To address this problem, the government turned to a charismatic figure named John Law, who proposed a radical solution to revive the economy. This study will explore why Law was given the opportunity to implement his financial alchemy in France and how it ultimately affected the country.

Context During the late 17th and early 18th centuries, Europe was plagued by a series of costly wars, including those fought by Louis XIV in France. The resulting public debt had become unsustainable for the French government, which faced its third bankruptcy in less than a century. Mercantilism, an economic system that emphasized state control over trade and finance, was prevalent during this period. The French monarchy relied heavily on taxation, borrowing, and inflation to fund its activities.

Timeline

- 1689-1697: Louis XIV’s wars against the Holy Roman Empire leave France with significant public debt.

- 1708: The Marquis of Torcy identifies John Law as a joueur (gambler) and possible spy.

- 1715: Louis XIV dies, leaving his successor, Louis XV, to deal with the country’s financial crisis.

- 1716: John Law proposes his financial plan to revive the French economy.

- 1717: The government allows Law to establish a national bank and issue paper money.

- 1719-1720: The value of the billets d’état (interest-bearing notes) plummets, causing economic instability.

Key Terms and Concepts

- Billet d’état: an interest-bearing note issued by the French government to fund its deficits.

- Joueur: a gambler or one who engages in speculative activities.

- Mercantilism: an economic system that emphasizes state control over trade and finance.

- Public debt: the accumulated financial obligations of a government, often resulting from wars and other large-scale expenditures.

- Financial alchemy: a metaphor for the radical and unproven financial solutions proposed by John Law.

Key Figures and Groups

- John Law: a Scottish economist and financier who proposed a series of radical financial reforms to revive the French economy.

- The Marquis of Torcy: Louis XIV’s Foreign Minister, who identified Law as a joueur (gambler) and possible spy in 1708.

- Louis XIV: King of France from 1643 to 1715, whose wars against the Holy Roman Empire left his country with significant public debt.

Mechanisms and Processes

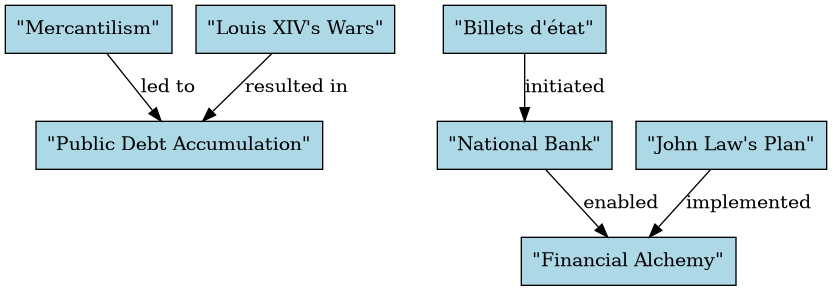

→ The French government’s reliance on mercantilism led to a buildup of public debt from Louis XIV’s wars. → The accumulation of debt forced the government to issue billets d’état, which eventually became worthless. → John Law proposed his financial plan, which included establishing a national bank and issuing paper money. → The government allowed Law to implement his plan, despite concerns about its validity.

Deep Background The French economy in the early 18th century was characterized by a series of complex relationships between trade, finance, and state power. Colonialism, imperialism, and mercantilism all played significant roles in shaping France’s economic landscape during this period. The country’s reliance on taxation, borrowing, and inflation to fund its activities had created an unstable financial environment.

Explanation and Importance John Law’s financial alchemy was a response to the desperate fiscal situation facing France. By proposing a national bank and paper money, Law hoped to revitalize the economy and alleviate the burden of public debt. However, his plan ultimately led to economic instability and the collapse of the billets d’état.

Comparative Insight The financial crisis in 18th century France can be compared to other periods of economic instability throughout history. For example, the Great Depression of the 1930s and the 2008 Global Financial Crisis both share similarities with the French experience, highlighting the ongoing challenges of managing public debt and regulating financial systems.

Extended Analysis

- The Role of Paper Money: John Law’s proposal to issue paper money was a key component of his financial plan. However, this move ultimately led to inflation and economic instability.

- The Impact of Mercantilism: France’s reliance on mercantilism had created an unsustainable economic environment, which Law’s plan attempted to address but ultimately exacerbated.

- The Limits of Financial Alchemy: The failure of John Law’s financial alchemy highlights the limitations of unproven and radical financial solutions.

Open Thinking Questions

• How did the French government’s reliance on mercantilism contribute to its financial crisis? • What were the key differences between John Law’s financial plan and traditional economic theories of his time? • In what ways do the events described above relate to contemporary issues in global finance?