British Investments in China, 1865-1914

British Investments in China, 1865-1914

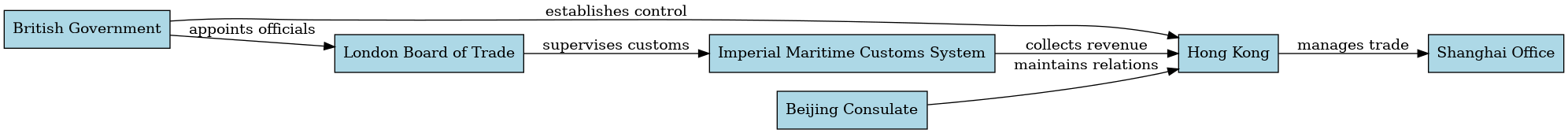

Overview Between 1865 and 1914, British investors poured at least £74 million into Chinese securities, a significant sum for impoverished China. This investment was facilitated by Britain’s control over Hong Kong and the Imperial Maritime Customs system, which ensured that part of the duties collected at China’s ports went towards paying interest on British-owned bonds. However, this investment was not immune to the risks of war, revolution, and economic instability.

Context The mid-19th century saw the emergence of a globalized economy, with European powers extending their influence over vast territories through colonialism, trade agreements, and financial investments. Britain, in particular, had established itself as a dominant world power, with a vast empire that included India, Africa, and Hong Kong. The Opium Wars (1839-1842, 1856-1860) marked the beginning of British control over Chinese ports and trade.

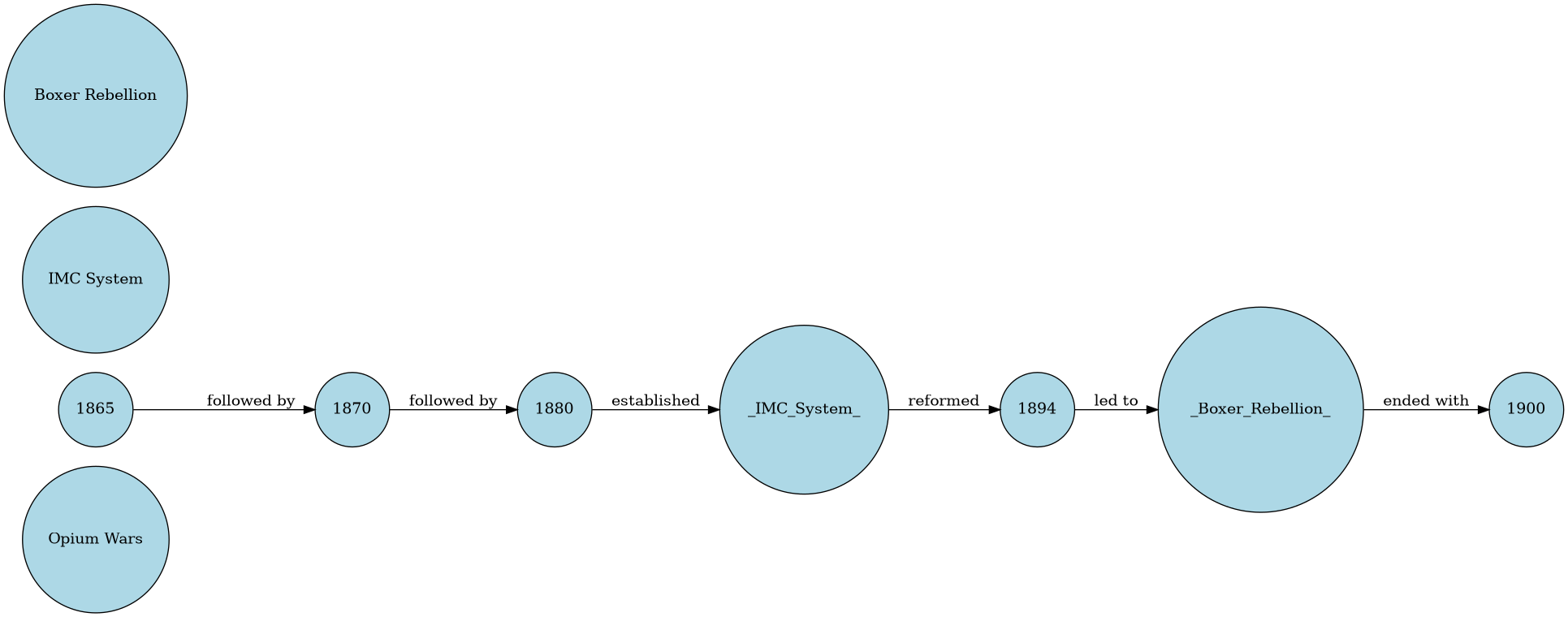

Timeline

- 1854: Britain gains control over the Imperial Maritime Customs system in China.

- 1865: British investors begin to invest heavily in Chinese securities.

- 1870s: Trade agreements between Britain and China lead to increased imports of British goods into China.

- 1880s: British banks establish themselves in Hong Kong, facilitating trade and investment between Britain and China.

- 1894-1895: War breaks out between China and Japan, leading to a decline in the value of Chinese bonds and stocks held by British investors.

- 1900: The Boxer Rebellion erupts in China, further destabilizing the economy and exacerbating losses for British investors.

- 1911: The revolution that overthrew the Qing dynasty brings an end to imperial rule in China.

Key Terms and Concepts

- Imperial Maritime Customs: A system of trade administration established by Britain in China, which collected duties on imports and exports.

- Treaty ports: Cities in China that were designated as centers for international trade, including Shanghai, Canton (now Guangzhou), and Amoy (now Xiamen).

- Thetaipan: A term used to describe a wealthy merchant or trader in the treaty ports of China.

- Boxer Rebellion: An anti-foreigner uprising in China that began in 1899 and was suppressed by an international coalition in 1900.

- Qing dynasty: The last imperial dynasty in China, which ruled from 1644 to 1912.

Key Figures and Groups

- Lord Salisbury: British Prime Minister who oversaw the extension of British control over Chinese ports through trade agreements and military intervention.

- Robert Hart: A British civil servant who served as Inspector-General of Customs for China and played a key role in establishing the Imperial Maritime Customs system.

- Li Hongzhang: A Chinese statesman who worked closely with British diplomats to establish trade agreements and stabilize the Chinese economy.

Mechanisms and Processes

→ British control over Hong Kong and the Imperial Maritime Customs system facilitated investment in Chinese securities by ensuring a stable source of revenue for bondholders. → Trade agreements between Britain and China led to increased imports of British goods into China, which helped to spur economic growth in both countries. → However, these investments were vulnerable to war, revolution, and economic instability, as seen during the Boxer Rebellion and the Japanese invasion of 1941.

Deep Background

The Opium Wars marked a turning point in the history of British-China relations. Britain’s victory over China led to the signing of the Treaty of Nanking (1842), which established Hong Kong as a British colony and opened up Chinese ports to trade with Europe. The subsequent treaties of Tientsin (1858) and Peking (1860) extended British control over Chinese customs and trade, setting the stage for the emergence of Hong Kong as a major financial center.

Explanation and Importance

The story of British investments in China between 1865 and 1914 highlights the complex interplay of economic, military, and diplomatic factors that shaped the globalized economy of the late 19th century. British investors were drawn to Chinese securities due to the stability offered by Britain’s control over Hong Kong and the Imperial Maritime Customs system. However, these investments were vulnerable to external shocks, such as war and revolution, which had devastating consequences for bondholders.

Comparative Insight

The experience of British investors in China between 1865 and 1914 shares similarities with other crises that affected globalized economies, including the Japanese invasion of 1941 and the Chinese takeover of Hong Kong in 1997. In each case, external shocks led to steep declines in the value of investments, highlighting the risks inherent in globalization.

Extended Analysis

- The role of imperialism: British control over China was a key factor in facilitating investment in Chinese securities. However, this control also created tensions and instability that ultimately affected investors.

- Globalization and risk: The story of British investments in China between 1865 and 1914 highlights the risks inherent in globalization, including war, revolution, and economic instability.

- The emergence of Hong Kong as a financial center: Britain’s control over Hong Kong facilitated the growth of the city into a major financial center, which played a key role in facilitating trade and investment between Britain and China.

Open Thinking Questions

• How did British investors assess the risks associated with investing in Chinese securities during this period? • In what ways did the Boxer Rebellion and other external shocks affect the global economy, beyond just the loss of investments by British bondholders? • What can we learn from the experience of British investors in China between 1865 and 1914 about the role of imperialism, globalization, and risk in shaping economic outcomes?